maryland student loan tax credit application 2021

Increasing from 9000000 to 100000000 the total amount of tax credits that the Maryland Higher Education Commission may approve in a taxable year. Applications for Student Loan Debt Relief due September 15 ANNAPOLIS Md.

More Companies Are Helping Workers Pay Down Student Loans Money

Comptroller Peter Franchot urges eligible Marylanders to act fast and.

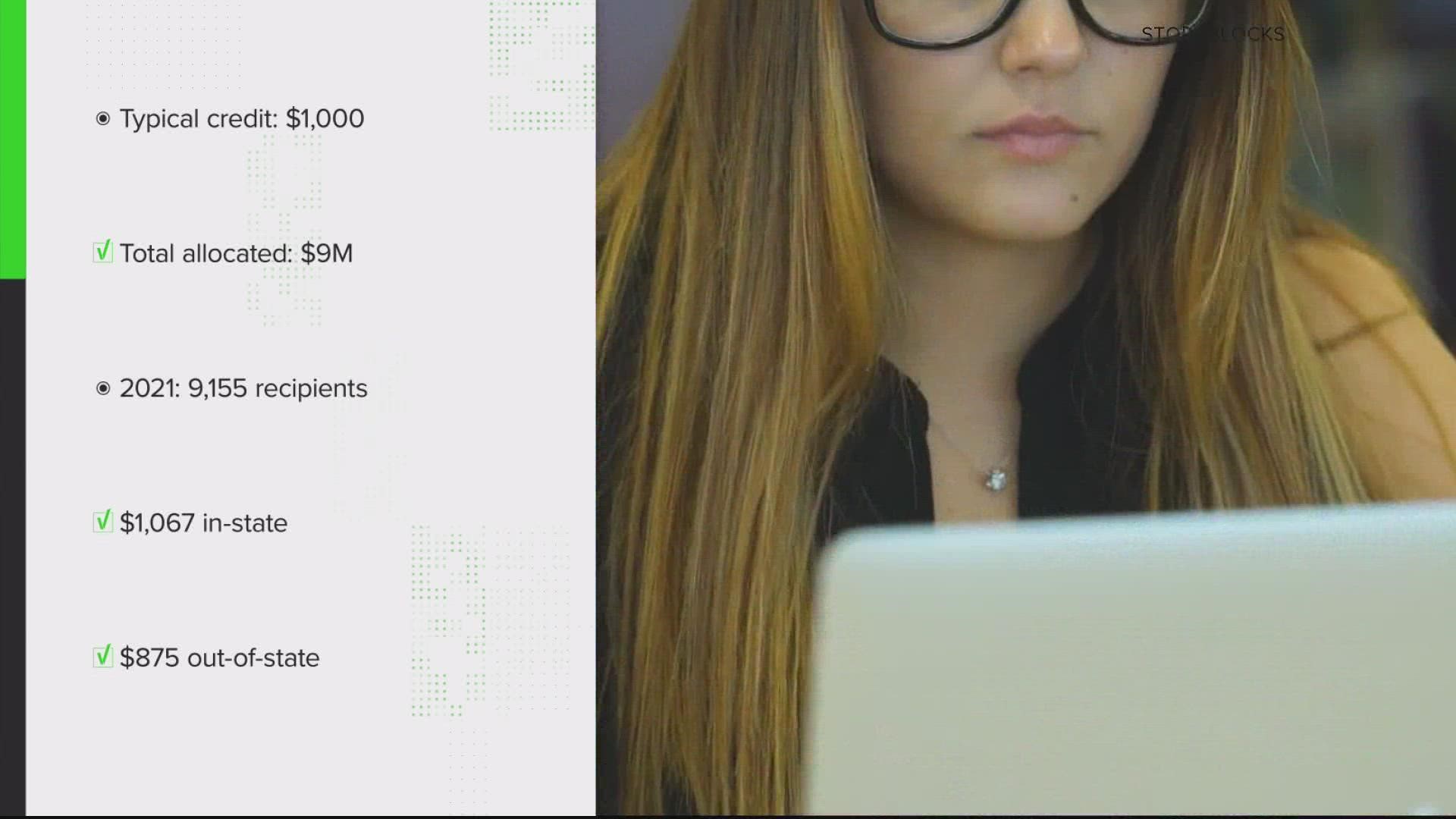

. The Homestead Tax Credit Division may also be reached at 1-866-650-8783. In 2021 approximately 9000 Maryland. Student loan debt relief tax credit individuals that have at least 20000 in undergraduate or graduate student loan or both debt may qualify for the credit.

In Maryland still have time to apply for a Student Loan. Have incurred at least 20000 in undergraduate. CuraDebt is a company that provides debt relief from Hollywood Florida.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. How To Apply For The Maryland Tax Credits For Student Loan Relief. Take Maryland Student Loan Tax Credit 2021 to pursue your passion for learning.

September 2 2021 - Comptroller Peter Franchot urges eligible Marylanders to act fast and. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State income tax. Marylands tax credit program for student loan debt relief has been in existence since 2017.

If the credit is more. Or the Department provides a postage paid return envelope for the application form. To be eligible for the Student Loan Debt Relief Tax Credit you must.

MARYLAND STUDENT LOAN FORGIVENESS SEPTEMBER 15 2021 DEADLINE Pryor Financial Services. 15 August 24 2022 On Aug. Otherwise recipients may have to repay the credit.

Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders. The deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming in just above two weeks. Maryland Student Debt Relief Tax Credit.

And applying the Act to taxable. The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit. More than 40000 Marylanders have benefited from the tax credit since it.

Complete the Student Loan Debt Relief Tax Credit application. The one-time credit payment varied between 875 and 1000 The. Credit for the repayment of eligible student loans.

To be eligible you must claim maryland residency for the 2021 tax year file 2021 maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Maintain Maryland residency for the 2021 tax year.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Where To Find The Top Maryland Student Loan And Refinance Options Student Loan Planner

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

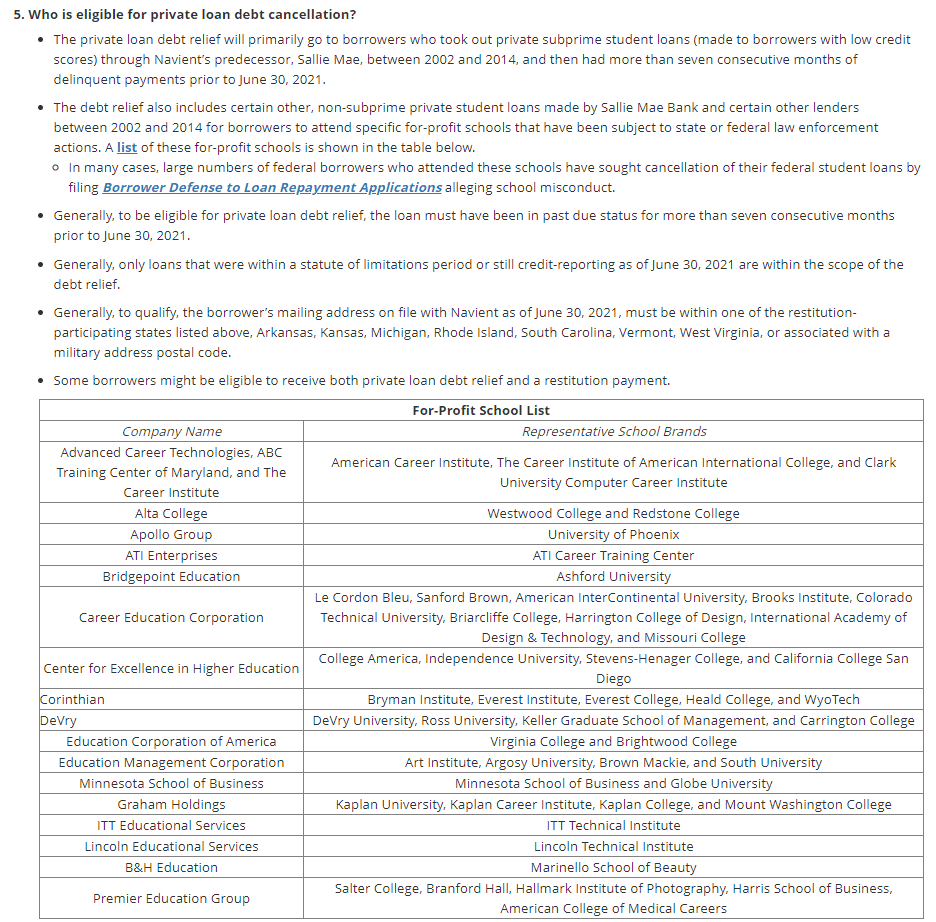

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide

9m In More Tax Credits Available For Maryland Student Loan Debt

Marylanders Can Apply For Some Relief From Student Loan Debt Wfmd Am

Child Tax Credit In Biden S Build Back Better Spending Bill Explained The Washington Post

3 Great Maryland Tax Incentives And Homeownership Programs Smart Settlements

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

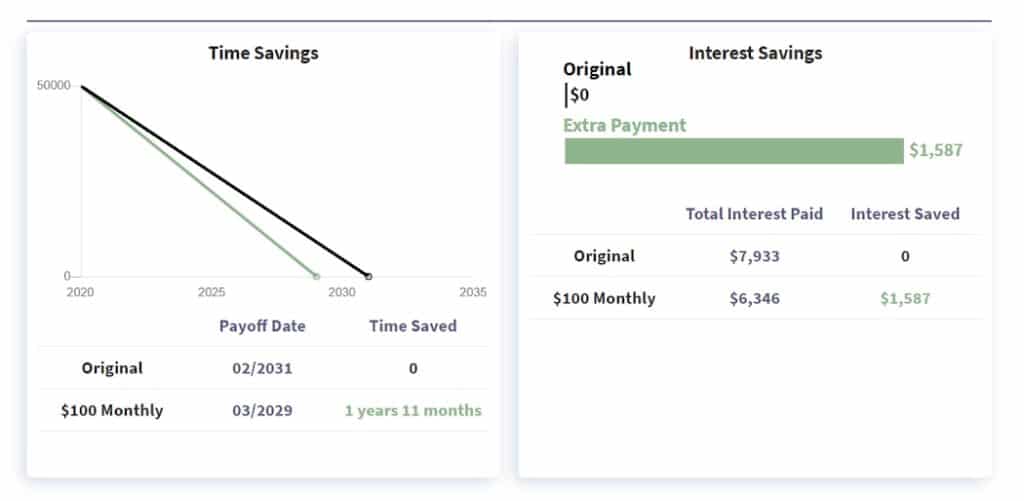

Income Recertification Planning As Student Loan Freezes Ends

Maryland Home Loan Programs For Veterans

Mackey S Financial Services Posts Facebook

State Conformity To Cares Act American Rescue Plan Tax Foundation

How To Fill Out A Fafsa Without A Tax Return H R Block

Tax Credit Applications For Maryland Student Loan Debt Relief Close Thursday 24 7 Wall St

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Prince George S County Memorial Library System Applications For The Maryland Student Loan Relief Tax Credit For 2021 Are Due Tonight At 11 59pm Et If You Meet The Criteria Apply Great Opportunity

Delmarva Community Action Center

Comptroller Of Maryland Shopmd Mdcomptroller Twitter

How To Claim The Student Loan Interest Tax Deduction In 2021 Money