lincoln ne sales tax rate 2018

The Nebraska state sales tax rate is currently. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

The 2018 United States Supreme Court decision in South Dakota v.

. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Lincoln NE. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

Fund 2018-2019 Tax Rate 2019-2020 Tax Rate General 020941 020981 Library 003733 003756. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. The Nebraska state sales and use tax rate is 55 055.

This rate includes any state county city and local sales taxes. Sales and Use Tax Rates Effective October 1 2018. This rate includes any state county city and local sales taxes.

Construction of four fire stations. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. The State of Nebraska sets a tax rate limit of 50 cents for municipalities which includes 45.

Lincolns City sales and use tax rate increase. The Nebraska sales tax rate is currently. The nebraska state sales and use tax rate is 55 055.

The Lincoln Nebraska general sales tax rate is 55. You can print a 725 sales tax table here. Lincoln is in the following zip codes.

Ad Have you expanded beyond marketplace selling. This is the total of state county and. The Nebraska state sales and use tax rate is 55 055.

In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. Avalara can help your business. The Lincoln County sales tax rate is.

Lincoln ne sales tax rate 2018. A bill lr11ca seeking a 2022 vote of the people on a constitutional amendment to replace the states income. The Nebraska state sales and use tax rate is 55 055.

This is the total of state county and city sales tax rates. There is no applicable county tax or special tax. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

Gavin Newsom will propose a temporary tax cut for. Lincoln ne sales tax rate 2018 Sunday June 5 2022 Edit. 2019 tax increment financing report for the city of lincoln in march of 2018 governor ricketts signed into law an amendment to the nebraska community development law.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Lincoln County NE. From 55 to 725 Every 2018 Q3 combined rates mentioned above are the results of Nebraska state rate 55 the Lincoln tax rate.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

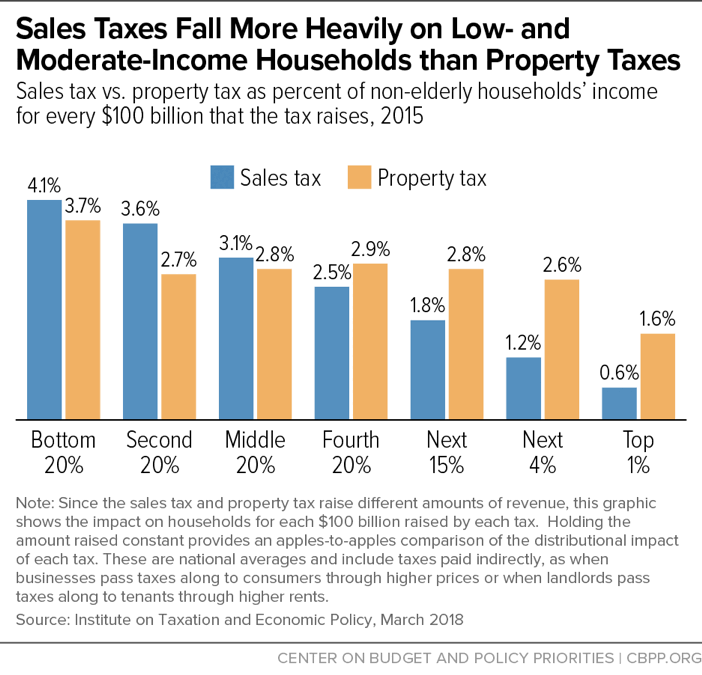

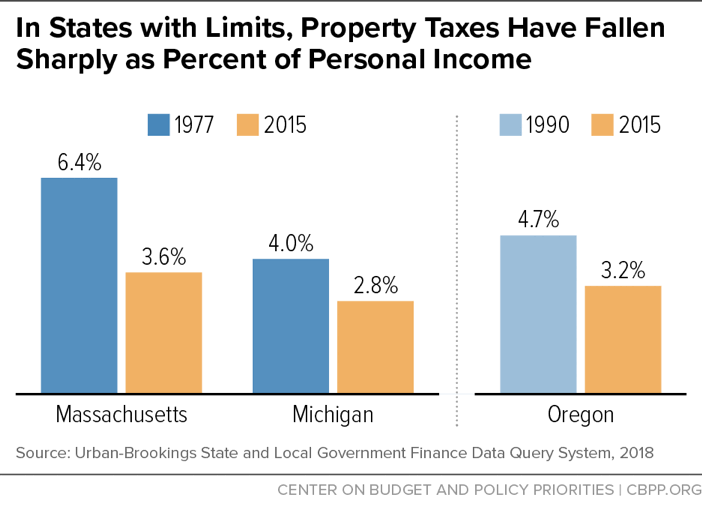

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

General Fund Receipts Nebraska Department Of Revenue

Sales Tax Rates In Major Cities Tax Data Tax Foundation

California Sales Tax Small Business Guide Truic

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Nebraska Sales Use Tax Guide Avalara

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities